This morning's announcement by IBM that it intends to acquire FileNet was a little surprising. Many observers had been suggesting that FileNet would drop soon, but I don't believe anyone guessed to IBM. My outsider view was that there was far too much overlap in their offerings for this to make sense from a technology viewpoint.

This morning's announcement by IBM that it intends to acquire FileNet was a little surprising. Many observers had been suggesting that FileNet would drop soon, but I don't believe anyone guessed to IBM. My outsider view was that there was far too much overlap in their offerings for this to make sense from a technology viewpoint.Thinking again, there seems to be a little sense to the acquisition, beyond absorbing a competitor. As Sandy Kemsley suggests in her Column 2 blog, the IBM SOA/integration capabilities paired with FileNet BPM could be a powerful combination. According to Sandy:

This is an area where FileNet provides a quite different and possibly complementary product to IBM, so I think that FileNet's BPM product could actually survive, get properly integrated with the IBM integration substructure, and become the product that it should have been years ago.

Much of the IBM data integration capability comes from their acquisition of Ascential, around March 2005. Combining the capabilities of WebSphere Information Integrator to access and manage a range of datasources with Ascential's abilities to transform and integrate the data into something meaningful, for migration or pure business intelligence, is quite powerful. One use case quoted is:

For example, a company trying to consolidate data from multiple ERP systems into a single system could leverage WebSphere Information Integrator to access various mainframe or distributed sources for profiling and assessment, and then use Ascential Software's data migration and transformation capabilities to integrate the data.

This gave IBM a sound basis for integration, migration and business intelligence at a technical level. Now add to that IBM's desire to strengthen its vertical solution plays. The acquisition of Webify to provide industry specific integration accelerators last week makes a lot of sense. Worked well, this gives IBM the ability to get at even more data from common vertical industry systems, especially across Insurance and Healthcare, with ready built adaptors and tools. Far more rapid deployment of systems becomes possible with this technology, as well as the opportunity to dislodge the niche integration vendors in certain industry segments, enabling IBM to own far more of an organization's overall architecture.

In combination, the integration pieces also enable IBM to handle one of the trickiest parts of systems combining a range of business applications and business process management. With some smart thinking they should be able to work out how to integrate the data to more easily provide a common structured datastore, enabling simplified synchronization of all of the data from all of the system components including BPM.

Organizations will benefit from this at several levels. From the technical level they will benefit if IBM can make this synchronization of shared data simpler and more accurate. From a business level they will benefit from enhanced data accuracy and consistency driving better customer service and reduced rate of operational errors.

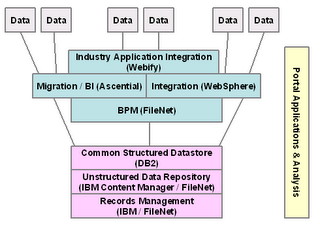

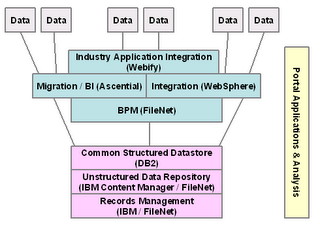

I have no idea if IBM has a formal vision for how all of these pieces look outside of a spending-spree. From a generic systems standpoint, I would see a common architecture a little like this:

This architecture gives IBM the ability to:

- Orchestrate human and systems processes (BPM)

- Manage a central integration infrastructure (WebSphere Integrator)

- Migrate and integrate data to a central datastore (Ascential / DB2)

- Access a range of industry specific datasources (Webify)

- Store unstructured data related to business processes (Content Manager / FileNet)

- Manage information lifecycle of all unstructured (documents) AND structured (systems data) through records retention policies (Records Manager)

- Present user and analytics applications through a common portal interface

With the FileNet acquisition, IBM gains a foot in the door to many corporations that have problems that they may have been attempting to solve with SOA and BPM in a piecemeal fashion. With the other recent acquisitions IBM could claim the ability to approach these problems in a broader, all encompassing technical approach.

If IBM really pushes this hard we could be about to experience the next generation of organizations bravely attempting massive systems re-engineering exercises, this time with a suite of products from a single vendor. Big Blue will again be the central figure of IT in many organizations.

Technorati tags: enterprise architecture IBM SOA BPM FileNet re-engineering

3 comments:

I think you made a really good point out of this news.

I also think that this acquisition was aimed at killing a direct competitor.

What I am personally wondering is why IBM had to work on these acquisitions while it could easily leverage on its internal skills.

Was it not going to be cheaper for IBM to engage its workforce on building such a systems re-engineering platform?

FileNet core business seems to be focused on Content Management operations, an area where it was competing with IBM. What is left is worth the acquisition?

Thank you

Diego

wayward2@libero.it

Diego, I agree with you, we are all going to have to wait and see what IBM does here. Its certainly going to make the most of its new customer base!

Thanks for reading. I hope you enjoy this enough to subscribe!

Phil

Thanks for the information, I like your take on blogging.

Post a Comment